The technical service life of a biogas plant generally amounts to 10-15 years. It is advisable to

calculate twice, one for a pessimistic assumption (10-year service life) and once for an optimistic

assumption (15-year service life). Similarly, the net profit should also be varied under pessimistic

and optimistic assumptions.

Evaluation: The user can at least expect the biogas plant to yield a positive return on his invested

capital. The actual interest should be in the range of locally achievable savings-account interest.

Also, the results of profitability calculation can be used to compare the financial quality of two

investment alternatives, but only if their respective service lives and investment volumes are

sufficiently comparable.

Calculating the profitability using the appendicized data

Initial investment, Io = 1100

Average capital invested, KA =Io / 2 = 550

Annual returns = 200

Loan servicing costs = none (internal financing)

Depreciation for 10 year service life = 110(case 1)

Depreciation for 15 year service life = 73.3 (case 2)

Net profit, NP1, for case 1 = 90

Net profit, NP2, for case 2 = 126.7

Return on investment in case 1 = NP1 /KA = 16%

Return on investment in case 2 = NP2 /KA = 23%

Thus, this sample calculation can be expected to show positive results regarding the achievable

return on invested capital.

8.4 Use of complex dynamic methods

Dynamic methods of micro-economic analysis are applied to biogas plants primarily by:

- extension officers, for the purpose of checking, by a dynamic technique, their own results of

static monetary analysis (cf. chapter 8.3), as already explained to the small farmers and

other users of biogas plants

- banks, as a decision-making criteria in connection with the granting of loans

- operators of large-scale biogas plants, for whom the financial side of the investment is an

important factor in the decision-making process.

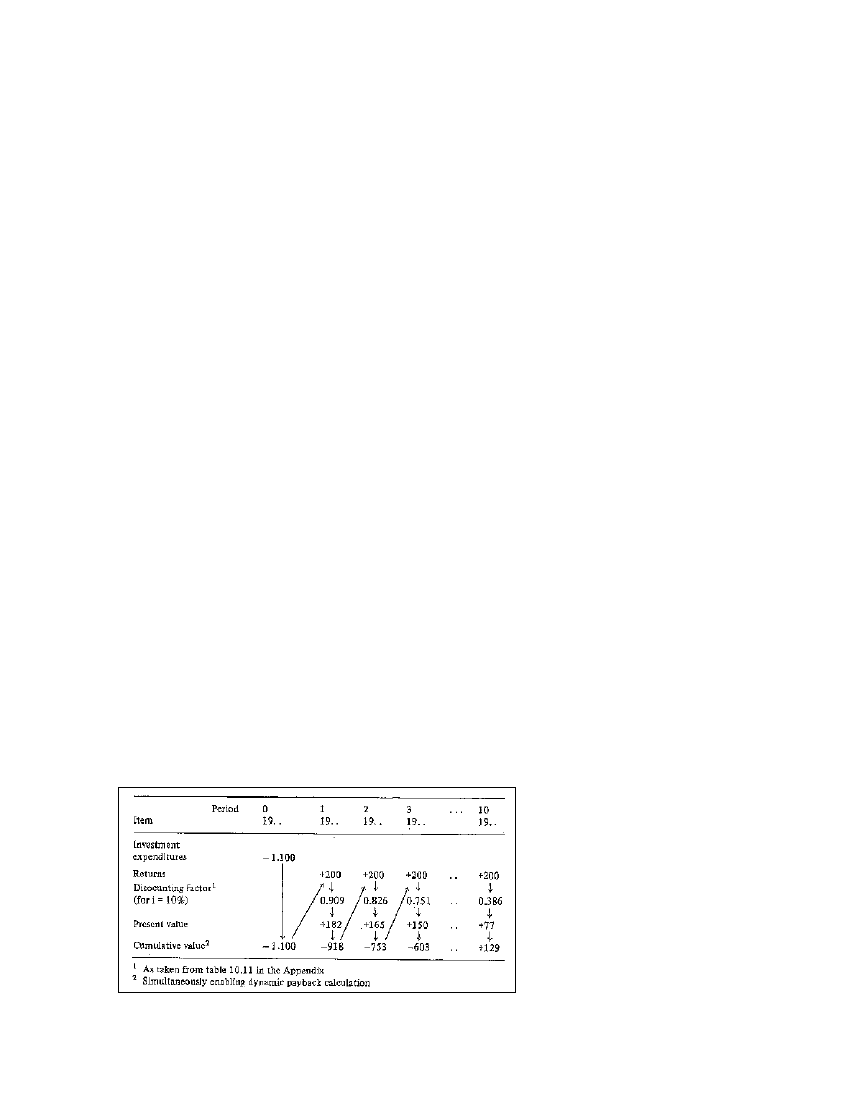

Table 8.4: Schedule of data for

net-present-value calculation

(with case example, data taken

from the appendicized

formsheet, table 10.10; Source:

OEKOTOP)

100