Wall Street

About this schools Wikipedia selection

SOS Children has tried to make Wikipedia content more accessible by this schools selection. Click here to find out about child sponsorship.

|

|

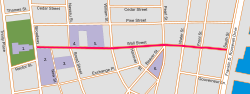

| West end | Broadway in Manhattan |

|---|---|

| East end | South Street in Manhattan |

| New Netherland series | |||

|---|---|---|---|

| Exploration | |||

| Fortifications: | |||

|

|||

| Settlements: | |||

|

|||

| The Patroon System | |||

| Charter of Freedoms and Exemptions | |||

| Directors of New Netherland: | |||

|

|||

| People of New Netherland | |||

|

|||

| Flushing Remonstrance | |||

Wall Street is the financial district of New York City, named after and centered on the eight-block-long street running from Broadway to South Street on the East River in Lower Manhattan. Over time, the term has become a metonym for the financial markets of the United States as a whole, the American financial sector (even if financial firms are not physically located there), or signifying New York-based financial interests. It is the home of the New York Stock Exchange, the world's largest stock exchange by market capitalization of its listed companies. Several other major exchanges have or had headquarters in the Wall Street area, including NASDAQ, the New York Mercantile Exchange, the New York Board of Trade, and the former American Stock Exchange. Anchored by Wall Street, New York City is one of the world's principal financial centers.

History

Early years

There are varying accounts about how the Dutch-named "de Waal Straat" got its name. A generally accepted version is that the name of the street was derived from an earthen wall on the northern boundary of the New Amsterdam settlement, perhaps to protect against English colonial encroachment or incursions by native Americans. A conflicting explanation is that Wall Street was named after Walloons—possibly a Dutch abbreviation for Walloon being Waal. Among the first settlers that embarked on the ship "Nieu Nederlandt" in 1624 were 30 Walloon families.

In the 1640s, basic picket and plank fences denoted plots and residences in the colony. Later, on behalf of the Dutch West India Company, Peter Stuyvesant, using both African slaves and white colonists, collaborated with the city government in the construction of a more substantial fortification, a strengthened 12-foot (4 m) wall. In 1685 surveyors laid out Wall Street along the lines of the original stockade. The wall started at Pearl Street, which was the shoreline at that time, crossing the Indian path Broadway and ending at the other shoreline (today's Trinity Place), where it took a turn south and ran along the shore until it ended at the old fort. In these early days, local merchants and traders would gather at disparate spots to buy and sell shares and bonds, and over time divided themselves into two classes—auctioneers and dealers. Wall Street was also the marketplace where owners could hire out their slaves by the day or week. The rampart was removed in 1699.

In the late 18th century, there was a buttonwood tree at the foot of Wall Street under which traders and speculators would gather to trade securities. The benefit was being in close proximity to each other. In 1792, traders formalized their association with the Buttonwood Agreement which was the origin of the New York Stock Exchange. The idea of the agreement was to make the market more "structured" and "without the manipulative auctions", with a commission structure. Persons signing the agreement agreed to charge each other a standard commission rate; persons not signing could still participate but would be charged a higher commission for dealing.

In 1789, Wall Street was the scene of the United States' first presidential inauguration when George Washington took the oath of office on the balcony of Federal Hall on April 30, 1789. This was also the location of the passing of the Bill Of Rights. In the cemetery of Trinity Church, Alexander Hamilton, who was the first Treasury secretary and "architect of the early United States financial system," is buried.

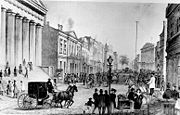

19th century

In the first few decades, both residences and businesses occupied the area, but increasingly business predominated. "There are old stories of people's houses being surrounded by the clamor of business and trade and the owners complaining that they can't get anything done," according to a historian named Burrows. The opening of the Erie Canal in the early 19th century meant a huge boom in business for New York City, since it was the only major eastern seaport which had direct access by inland waterways to ports on the Great Lakes. Wall Street became the "money capital of America".

Historian Charles R. Geisst suggested that there has constantly been a "tug-of-war" between business interests on Wall Street and authorities in Washington, D.C.. Generally during the 19th century Wall Street developed its own "unique personality and institutions" with little outside interference.

In the 1840s and 1850s, most residents moved north to midtown because of the increased business use at the lower tip of the island. The Civil War had the effect of causing the northern economy to boom, bringing greater prosperity to cities like New York which "came into its own as the nation's banking centre" connecting "Old World capital and New World ambition", according to one account. J. P. Morgan created giant trusts; John D. Rockefeller’s Standard Oil moved to New York. Between 1860 and 1920, the economy changed from "agricultural to industrial to financial" and New York maintained its leadership position despite these changes, according to historian Thomas Kessner. New York was second only to London as the world's financial capital.

In 1884, Charles H. Dow began tracking stocks, initially beginning with 11 stocks, mostly railroads, and looked at average prices for these eleven. When the average "peaks and troughs" went up consistently, he deemed it a bull market condition; if averages dropped, it was a bear market. He added up prices, and divided by the number of stocks to get his Dow Jones average. Dow's numbers were a "convenient benchmark" for analyzing the market and became an accepted way to look at the entire stock market.

In 1889, the original stock report, Customers' Afternoon Letter, became The Wall Street Journal. Named in reference to the actual street, it became an influential international daily business newspaper published in New York City. After October 7, 1896, it began publishing Dow's expanded list of stocks. A century later, there were 30 stocks in the average.

20th century

Historian John Brooks in his book Once in Golconda considered the start of the 20th century period to have been Wall Street's heyday. The address of 23 Wall Street where the headquarters of J. P. Morgan & Company, known as The Corner, was "the precise centre, geographical as well as metaphorical, of financial America and even of the financial world."

Wall Street has had changing relationships with government authorities. In 1913, for example, when authorities proposed a $4 tax on stock transfers, stock clerks protested. At other times, city and state officials have taken steps through tax incentives to encourage financial firms to continue to do business in the city.

In the late 19th and early 20th centuries, the corporate culture of New York was a primary centre for the construction of skyscrapers, and was rivaled only by Chicago on the American continent. There were also residential sections, such as the Bowling Green section between Broadway and the Hudson river, and between Vesey Street and the Battery. The Bowling Green area was described as "Wall Street's back yard" with poor people, high infant mortality rates, and the "worst housing conditions in the city." As a result of the construction, looking at New York City from the east, one can see two distinct clumps of tall buildings—the financial district on the left, and the taller midtown district on the right. The geology of Manhattan is well-suited for tall buildings, with a solid mass of bedrock underneath Manhattan providing a firm foundation for tall buildings. Skyscrapers are expensive to build, but when there is a "short supply of land" in a "desirable location", then building upwards makes sound financial sense. A post office was built at 60 Wall Street in 1905. During the World War I years, occasionally there were fund-raising efforts for projects such as the National Guard.

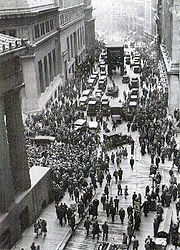

On September 16, 1920, close to the corner of Wall and Broad Street, the busiest corner of the financial district and across the offices of the Morgan Bank, a powerful bomb exploded. It killed 38 and seriously injured 143 people. The perpetrators were never identified or apprehended. The explosion did, however, help fuel the Red Scare that was underway at the time. A report from The New York Times:

| “ | The tomb-like silence that settles over Wall Street and lower Broadway with the coming of night and the suspension of business was entirely changed last night as hundreds of men worked under the glare of searchlights to repair the damage to skyscrapers that were lighted up from top to bottom. ... The Assay Office, nearest the point of explosion, naturally suffered the most. The front was pierced in fifty places where the cast iron slugs, which were of the material used for window weights, were thrown against it. Each slug penetrated the stone an inch or two and chipped off pieces ranging from three inches to a foot in diameter. The ornamental iron grill work protecting each window was broken or shattered. ... the Assay Office was a wreck. ... It was as though some gigantic force had overturned the building and then placed it upright again, leaving the framework uninjured but scrambling everything inside. -- 1920 | ” |

The area was subjected to numerous threats; one bomb threat in 1921 led to detectives sealing off the area to "prevent a repetition of the Wall Street bomb explosion."

Regulation

In October 1929, celebrated Yale economist Irving Fisher reassured worried investors that their "money was safe" on Wall Street. A few days later, stock values plummeted. The stock market crash of 1929 ushered in the Great Depression in which a quarter of working people were unemployed, with soup kitchens, mass foreclosures of farms, and falling prices. During this era, development of the financial district stagnated, and Wall Street "paid a heavy price" and "became something of a backwater in American life." During the New Deal years as well as the 1940s, there was much less focus on Wall Street and finance. The government clamped down on the practice of buying equities based only on credit, but these policies began to ease. From 1946-1947, stocks could not be purchased " on margin", meaning that an investor had to pay 100% of a stock's cost without taking on any loans. But this margin requirement was reduced four times before 1960, each time stimulating a mini-rally and boosting volume, and when the Federal Reserve reduced the margin requirements from 90% to 70%. These changes made it somewhat easier for investors to buy stocks on credit. The growing national economy and prosperity led to a recovery during the 1960s, with some down years during the early 1970s in the aftermath of the Vietnam War. Trading volumes climbed; in 1967, according to Time Magazine, volume hit 7.5 million shares a day which caused a "traffic jam" of paper with "batteries of clerks" working overtime to "clear transactions and update customer accounts."

In 1973, the financial community posted a collective loss of $245 million, which spurred temporary help from the government. Reforms happened; the SEC eliminated fixed commissions, which forced "brokers to compete freely with one another for investors' business." In 1975, the Securities & Exchange Commission threw out the NYSE's "Rule 394" which had required that "most stock transactions take place on the Big Board's floor", in effect freeing up trading for electronic methods. In 1976, banks were allowed to buy and sell stocks, which provided more competition for stockbrokers. Reforms had the effect of lowering prices overall, making it easier for more people to participate in the stock market. Broker commissions for each stock sale lessened, but volume increased.

The Reagan years were marked by a renewed push for capitalism, business, with national efforts to de-regulate industries such as telecommunications and aviation. The economy resumed upward growth after a period in the early 1980s of languishing. A report in The New York Times described that the flushness of money and growth during these years had spawned a drug culture of sorts, with a rampant acceptance of cocaine use although the overall percent of actual users was most likely small. A reporter wrote:

| “ | The Wall Street drug dealer looked like many other successful young female executives. Stylishly dressed and wearing designer sunglasses, she sat in her 1983 Chevrolet Camaro in a no-parking zone across the street from the Marine Midland Bank branch on lower Broadway. The customer in the passenger seat looked like a successful young businessman. But as the dealer slipped him a heat-sealed plastic envelope of cocaine and he passed her cash, the transaction was being watched through the sunroof of her car by Federal drug agents in a nearby building. And the customer - an undercover agent himself -was learning the ways, the wiles and the conventions of Wall Street's drug subculture. -- Peter Kerr in the New York Times, 1987. | ” |

In 1987, the stock market plunged and, in the relatively brief recession following, lower Manhattan lost 100,000 jobs according to one estimate. Since telecommunications costs were coming down, banks and brokerage firms could move away from Wall Street to more affordable locations. The recession of 1990–1991 were marked by office vacancy rates downtown which were "persistently high" and with some buildings "standing empty." The day of the drop, October 20, was marked by "stony-faced traders whose sense of humor had abandoned them and in the exhaustion of stock exchange employees struggling to maintain orderly trading." Ironically, it was the same year that Oliver Stone's movie Wall Street appeared. In 1995, city authorities offered the Lower Manhattan Revitalization Plan which offered incentives to convert commercial properties to residential use.

Construction of the World Trade Centre began in 1966 but had trouble attracting tenants when completed. Nonetheless, some substantial firms purchased space there. Its impressive height helped make it a visual landmark for drivers and pedestrians. In some respects, the nexus of the financial district moved from the street of Wall Street to the Trade Centre complex. Real estate growth during the latter part of the 1990s was significant, with deals and new projects happening in the financial district and elsewhere in Manhattan; one firm invested more than $24 billion in various projects, many in the Wall Street area. In 1998, the NYSE and the city struck a $900 million deal which kept the NYSE from moving across the river to Jersey City; the deal was described as the "largest in city history to prevent a corporation from leaving town". A competitor to the NYSE, NASDAQ, moved its headquarters from Washington to New York.

21st-century

In the first year of the new century, the Big Board, as some termed the NYSE, was described as the world's "largest and most prestigious stock market." But when the World Trade Centre was destroyed on September 11th, 2001, it left an architectural void as new developments since the 1970s had played off the complex aesthetically. The attacks "crippled" the communications network. One estimate was that 45% of Wall Street's "best office space" had been lost. The physical destruction was immense:

| “ | Debris littered some streets of the financial district. National Guard members in camouflage uniforms manned checkpoints. Abandoned coffee carts, glazed with dust from the collapse of the World Trade Centre, lay on their sides across sidewalks. Most subway stations were closed, most lights were still off, most telephones did not work, and only a handful of people walked in the narrow canyons of Wall Street yesterday morning. -- Leslie Eaton and Kirk Johnson of the New York Times, September 16, 2001. | ” |

Still, the NYSE was determined to re-open on September 17, almost a week after the attack. The attack hastened a trend towards financial firms moving to midtown and contributed to the loss of business on Wall Street, due to temporary-to-permanent relocation to New Jersey and further decentralization with establishments transferred to cities like Chicago, Denver, and Boston.

After September 11, the financial services industry went through a downturn with a sizable drop in year-end bonuses of $6.5 billion, according to one estimate from a state comptroller's office. Many brokers are paid mostly through commission, and get a token annual salary which is dwarfed by the year-end bonus.

To guard against a vehicular bombing in the area, authorities built concrete barriers, and found ways over time to make them more aesthetically appealing by spending $5000 to $8000 apiece on bollards:

| “ | To prevent a vehicle-delivered bomb from entering the area, Rogers Marvel designed a new kind of bollard, a faceted piece of sculpture whose broad, slanting surfaces offer people a place to sit in contrast to the typical bollard, which is supremely unsittable. The bollard, which is called the Nogo, looks a bit like one of Frank Gehry's unorthodox culture palaces, but it is hardly insensitive to its surroundings. Its bronze surfaces actually echo the grand doorways of Wall Street's temples of commerce. Pedestrians easily slip through groups of them as they make their way onto Wall Street from the area around historic Trinity Church. Cars, however, cannot pass. -- Blair Kamin in the Chicago Tribune, 2006 | ” |

Wall Street itself and the Financial District as a whole are crowded with highrises. Further, the loss of the World Trade Center has spurred development on a scale that hadn't been seen in decades. In 2006, Goldman Sachs began building a tower near the former Trade Center site. Tax incentives provided by federal, state and local governments encouraged development. A new World Trade Centre complex, centered on Daniel Liebeskind's Memory Foundations plan, is in the early stages of development and one building has already been replaced. The centerpiece to this plan is the 1,776-foot (541 m) tall 1 World Trade Centre (formerly known as the Freedom Tower). New residential buildings are sprouting up, and buildings that were previously office space are being converted to residential units, also benefiting from tax incentives. A new Fulton Centre is planned to improve access. In 2007, the Maharishi Global Financial Capital of New York opened headquarters at 70 Broad Street near the NYSE, in an effort to seek investors.

The Guardian reporter Andrew Clark described the years of 2006 to 2010 as "tumultous" in which the heartland of America is "mired in gloom" with high unemployment around 9.6%, with average house prices falling from $230,000 in 2006 to $183,000, and foreboding increases in the national debt to $13.4 trillion, but that despite the setbacks, the American economy was once more "bouncing back." What had happened during these heady years? Clark wrote:

| “ | But the picture is too nuanced simply to dump all the responsibility on financiers. Most Wall Street banks didn't actually go around the US hawking dodgy mortgages; they bought and packaged loans from on-the-ground firms such as Countrywide Financial and New Century Financial, both of which hit a financial wall in the crisis. Foolishly and recklessly, the banks didn't look at these loans adequately, relying on flawed credit-rating agencies such as Standard & Poor's and Moody's, which blithely certified toxic mortgage-backed securities as solid... A few of those on Wall Street, including maverick hedge fund manager John Paulson and the top brass at Goldman Sachs, spotted what was going on and ruthlessly gambled on a crash. They made a fortune but turned into the crisis's pantomime villains. Most, though, got burned – the banks are still gradually running down portfolios of non-core loans worth $800bn. -- The Guardian reporter Andrew Clark, 2010. | ” |

The first months of 2008 was a particularly troublesome period which caused Federal Reserve chairman Benjamin Bernanke to "work holidays and weekends" and which did an "extraordinary series of moves." It bolstered U.S. banks and allowed Wall Street firms to borrow "directly from the Fed." These efforts were highly controversial at the time, but from the perspective of 2010, it appeared the Federal exertions had been the right decisions. By 2010, Wall Street firms, in Clark's view, were "getting back to their old selves as engine rooms of wealth, prosperity and excess." A report by Michael Stoler in The New York Sun described a "phoenix-like resurrection" of the area, with residential, commercial, retail and hotels booming in the "third largest business district in the country." At the same time, the investment community was worried about proposed legal reforms, including the Wall Street Reform and Consumer Protection Act which dealt with matters such as credit card rates and lending requirements. The NYSE closed two of its trading floors in a move towards transforming itself into an electronic exchange. Beginning in September 2011, demonstrators disenchanted with the financial system protested in parks and plazas around Wall Street.

Buildings: Physical layout

Wall Street's architecture is generally rooted in the Gilded Age, though there are also some art deco influences in the neighbourhood. The layout of streets doesn't have the rectangular grid pattern typical of midtown Manhattan, but small streets "barely wide enough for a single lane of traffic are bordered on both sides by some of the tallest buildings in the city", according to one description, which creates "breathtaking artificial canyons" offering spectacular views in some instances. Construction in such narrow steep areas has resulted in occasional accidents such as a crane collapse. One report divided lower Manhattan into three basic districts:

- The financial district proper—particularly along John Street

- South of the World Trade Center area—the handful of blocks south of the World Trade Centre along Greenwich, Washington and West Streets

- Seaport district—characterized by century-old low-rise buildings and South Street Seaport; the seaport is "quiet, residential, and has an old world charm" according to one description.

Landmark buildings on Wall Street include Federal Hall, 14 Wall Street ( Bankers Trust Company Building), 40 Wall Street (The Trump Building) the New York Stock Exchange at the corner of Broad Street and the US headquarters of Deutsche Bank at 60 Wall Street. The Deutsche Bank building (formerly the J.P Morgan headquarters) is the last remaining major investment bank to still have its headquarters on Wall Street.

The older skyscrapers often were built with elaborate facades; such elaborate aesthetics haven't been common in corporate architecture for decades. The World Trade Centre, built in the 1970s, was very plain and utilitarian in comparison (the Twin Towers were often criticized as looking like two big boxes, despite their impressive height). Excavation from the World Trade Centre was later used by Battery Park City residential development as landfill. 23 Wall Street was built in 1914 and was known as the " House of Morgan" and served for decades as the bank's headquarters and, by some accounts, was viewed as an important address in American finance.

A key anchor for the area is, of course, the New York Stock Exchange. City authorities realize its importance, and believed that it has "outgrown its neoclassical temple at the corner of Wall and Broad streets", and in 1998 offered substantial tax incentives to try to keep it in the financial district. Plans to rebuild it were delayed by the events of 2001. In 2011, the exchange still occupies the same site. The exchange is the locus for an impressive amount of technology and data. For example, to accommodate the three thousand persons who work directly on the Exchange floor requires 3,500 kilowatts of electricity, along with 8,000 phone circuits on the trading floor alone, and 200 miles of fibre-optic cable below ground.

Personalities: players and deal-makers

Persons associated with Wall Street have become famous. Although their reputations are usually limited to members of the stock brokerage and banking communities, several have gained national and international fame. Some earned their fame for their investment strategies, financing, reporting, legal or regulatory skills, while others are remembered for their greed. One of the most iconic representations of the market prosperity is the Charging Bull sculpture, by Arturo Di Modica. Representing the bull market economy, the sculpture was originally placed in front of the New York Stock Exchange, and subsequently moved to its current location in Bowling Green.

Wall Street's culture is often criticized as being rigid. This is a decades-old stereotype stemming from the Wall Street establishment's protection of its interests, and the link to the WASP establishment. More recent criticism has centered on structural problems and lack of a desire to change well-established habits. Wall Street's establishment resists government oversight and regulation. At the same time, New York City has a reputation as a very bureaucratic city, which makes entry into the neighbourhood difficult or even impossible for middle class entrepreneurs.

Several well known Wall Street individuals include John Meriwether, John Briggs, Michael Bloomberg, and Warren Buffett (all affiliated at one time or another with the firm Salomon Brothers), as well as Bernie Madoff, and numerous others.

Many talented financiers and bankers worked for Wasserstein Perella & Co. during the 1980s.

The now defunct investment bank of Donaldson, Lufkin & Jenrette had numerous talented people working there including people such as William Donaldson who served in the Nixon administration, as well as Ken Moelis, Bennett Goodman, Herald "Hal" Ritch, Joel Cohen, Safra A. Catz who became president of Oracle Corporation, Tom Dean, Larry Schloss, Michael Connelly, and others.

Wall Street as a financial centre

Wall Street in the New York economy

Finance professor Charles R. Geisst wrote that the exchange has become "inextricably intertwined into New York's economy". Wall Street pay, in terms of salaries and bonuses and taxes, is an important part of the economy of New York City, the tri-state metropolitan area, and the United States. In 2008, after a downturn in the stock market, the decline meant $18 billion less in taxable income, with less money available for "apartments, furniture, cars, clothing and services". A falloff in Wall Street's economy could have "wrenching effects on the local and regional economies".

Estimates vary about the number and quality of financial jobs in the city. One estimate was that Wall Street firms employed close to 200,000 persons in 2008. Another estimate was that in 2007, the financial services industry which had a $70 billion profit became 22 percent of the city's revenue. Another estimate (in 2006) was that the financial services industry makes up 9% of the city's work force and 31% of the tax base. An additional estimate (2007) from Steve Malanga of the Manhattan Institute was that the securities industry accounts for 4.7 percent of the jobs in New York City but 20.7 percent of its wages, and he estimated there were 175,000 securities-industries jobs in New York (both Wall Street area and midtown) paying an average of $350,000 annually. Between 1995 and 2005, the sector grew at an annual rate of about 6.6% annually, a respectable rate, but that other financial centers were growing faster. Another estimate (2008) was that Wall Street provided a fourth of all personal income earned in the city, and 10% of New York City's tax revenue.

The seven largest Wall Street firms in the 2000s (decade) were Bear Stearns, JPMorgan Chase, Citigroup Incorporated, Goldman Sachs, Morgan Stanley, Merrill Lynch and Lehman Brothers. During the recession of 2008–2010, many of these firms went out of business or were bought up at firesale prices by other financial firms. In 2008, Lehman filed for bankruptcy, Bear Stearns was bought by JP Morgan Chase forced by the U.S. government, and Merrill Lynch was bought by Bank of America in a similar shot-gun wedding. These failures marked a catastrophic downsizing of Wall Street as the financial industry goes through restructuring and change. Since New York's financial industry provides almost one-fourth of all income produced in the city, and accounts for 10% of the city's tax revenues and 20% of the state's, the downturn has had huge repercussions for government treasuries. New York's mayor Michael Bloomberg reportedly over a four-year period dangled over $100 million in tax incentives to persuade Goldman Sachs to build a 43-story headquarters in the financial district near the destroyed World Trade Centre site. In 2009, things looked somewhat gloomy, with one analysis by the Boston Consulting Group suggesting that 65,000 jobs had been permanently lost because of the downturn. But there were signs that Manhattan property prices were rebounding with price rises of 9% annually in 2010, and bonuses were being paid once more, with average bonuses over $124,000 in 2010. The U.S. banking industry employs 1.86 million people and earned profits of $22 billion in the second quarter of 2010, up substantially from previous quarters.

Wall Street versus Midtown Manhattan

A requirement of the New York Stock Exchange was that brokerage firms had to have offices "clustered around Wall Street" so clerks could deliver physical paper copies of stock certificates each week. There were some indications that midtown had been becoming the locus of financial services dealings even by 1911. But as technology progressed, in the middle and later decades of the 20th century, computers and telecommunications replaced paper notifications, meaning that the close proximity requirement could be bypassed in more situations. Many financial firms found that they could move to midtown Manhattan four miles away or elsewhere and still operate effectively. For example, the former investment firm of Donaldson, Lufkin & Jenrette was described as a Wall Street firm but had its headquarters on Park Avenue in midtown. A report described the migration from Wall Street:

| “ | The financial industry has been slowly migrating from its historic home in the warren of streets around Wall Street to the more spacious and glamorous office towers of Midtown Manhattan. Morgan Stanley, J.P. Morgan Chase, Citigroup, and Bear Stearns have all moved north. -- USA Today, October 2001. | ” |

Nevertheless, a key magnet for the Wall Street remains the New York Stock Exchange. Some "old guard" firms such as Goldman Sachs and Merrill Lynch (bought by Bank of America in 2009), have remained "fiercely loyal to the financial district" location, and new ones such as Deutsche Bank have chosen office space in the district. So-called "face–to–face" trading between buyers and sellers remains a "cornerstone" of the NYSE, with a benefit of having all of a deal's players close at hand, including investment bankers, lawyers, and accountants.

In 2011, the Manhattan Financial District is one of the largest business districts in the United States, and second in New York City only to Midtown in terms of dollar volume of business transacted.

Wall Street as a neighbourhood

During most of the 20th century, Wall Street was a business community with practically only offices which emptied out at night. A report in the New York Times in 1961 described a "deathlike stillness that settles on the district after 5:30 and all day Saturday and Sunday." But there has been a change towards greater residential use of the area, pushed forwards by technological changes and shifting market conditions. The general pattern is for several hundred thousand workers to commute into the area during the day, sometimes by sharing a taxicab from other parts of the city as well as from New Jersey and Long Island, and then leave at night. In 1970, only 833 people lived "south of Chambers Street"; by 1990; 13,782 people were residents with the addition of areas such as Battery Park City and Southbridge Towers. Battery Park City was built on 92 acres of landfill, and 3,000 people moved there beginning about 1982, but by 1986 there was evidence of more shops and stores and a park, along with plans for more residential development.

According to one description in 1996, "The area dies at night ... It needs a neighbourhood, a community." During the past two decades there has been a shift towards greater residential living areas in the Wall Street area, with incentives from city authorities in some instances. Many empty office buildings have been converted to lofts and apartments; for example, the office building of Harry Sinclair, the oil magnate involved with the Teapot Dome scandal, was converted to a co-op in 1979. In 1996, a fifth of buildings and warehouses were empty, and many were converted to living areas. Some conversions met with problems, such as aging gargoyles on building exteriors having to be expensively restored to meet with current building codes. Residents in the area have sought to have a supermarket, a movie theatre, a pharmacy, more schools, and a "good diner". The discount retailer named Job Lot used to be located at the World Trade Centre but moved to Church Street; merchants bought extra unsold items at steep prices and sold them as a discount to consumers and shoppers included "thrifty homemakers and browsing retirees" who "rubbed elbows with City Hall workers and Wall Street executives"; but the firm went bust in 1993. There were reports that the number of residents increased by 60% during the 1990s to about 25,000 although a second estimate (based on the 2000 census based on a different map) places the residential (nighttime and weekend) population in 2000 at 12,042. By 2001, there were several grocery stores, dry cleaners, and two grade schools and a top high school. There is a barber shop across from the New York Stock Exchange which has been there a long time. By 2001, there were more signs of dogwalkers at night and a 24-hour neighbourhood, although the general pattern of crowds during the working hours and emptiness at night was still apparent. There were ten hotels and thirteen museums by 2001. Stuyvesant High School moved to its present location near Battery Park City in 1992 and has been described as one of the nation's premier high schools with emphasis on science and mathematics. In 2007, the French fashion retailer Hermès opened a store in the financial district to sell items such as a "$4,700 custom-made leather dressage saddle or a $47,000 limited edition alligator briefcase." Some streets have been designated as pedestrian–only with vehicular traffic prohibited at some times. There are reports of panhandlers like elsewhere in the city. By 2010, the residential population had increased to 24,400 residents with crime statistics showing no murders in 2010. The area is growing with luxury high-end apartments and upscale retailers.

Wall Street as a tourist destination

Wall Street is a major location of tourism in New York City. One report described lower Manhattan as "swarming with camera-carrying tourists". Tour guides highlight places such as Trinity Church, the Federal Reserve gold vaults 80 feet below street level (worth $100 billion), and the NYSE. A Scoundrels of Wall Street Tour is a walking historical tour which includes a museum visit and discussion of various financiers "who were adept at finding ways around finance laws or loopholes through them". Occasionally artists make impromptu performances; for example, in 2010, a troupe of 22 dancers "contort their bodies and cram themselves into the nooks and crannies of the Financial District in Bodies in Urban Spaces" choreographed by Willi Donner. One chief attraction, the Federal Reserve Building in lower Manhattan, paid $750,000 to open a visitors' gallery in 1997. The New York Stock Exchange and the American Stock Exchange also spent money in the late 1990s to upgrade facilities for visitors. Attractions include the gold vault beneath the Federal Reserve and that "staring down at the trading floor was as exciting as going to the Statue of Liberty."

Wall Street versus Main Street

As a figure of speech contrasted to " Main Street", the term "Wall Street" can refer to big business interests against those of small business and the working of middle class. It is sometimes used more specifically to refer to research analysts, shareholders, and financial institutions such as investment banks. Whereas "Main Street" conjures up images of locally owned businesses and banks, the phrase "Wall Street" is commonly used interchangeably with the phrase "Corporate America". It is also sometimes used in contrast to distinguish between the interests, culture, and lifestyles of investment banks and those of Fortune 500 industrial or service corporations.

Wall Street in the public imagination

Wall Street in a conceptual sense represents financial and economic power. To Americans, it can sometimes represent elitism and power politics, and its role has been a source of controversy throughout the nation's history, particularly beginning around the Gilded Age period in the late 19th century. Wall Street became the symbol of a country and economic system that many Americans see as having developed through trade, capitalism, and innovation.

Wall Street has become synonymous with financial interests, often used negatively. During the subprime mortgage crisis from 2007–2010, Wall Street financing was blamed as one of the causes, although most commentators blame an interplay of factors. The U.S. government with the Troubled Asset Relief Program bailed out the banks and financial backers with billions of taxpayer dollars, but the bailout was often criticized as politically motivated, and was criticized by journalists as well as the public. Analyst Robert Kuttner in the Huffington Post criticized the bailout as helping large Wall Street firms such as Citigroup while neglecting to help smaller community development banks such as Chicago's ShoreBank. One writer in the Huffington Post looked at FBI statistics on robbery, fraud, and crime and concluded that Wall Street was the "most dangerous neighbourhood in the United States" if one factored in the $50 billion fraud perpetrated by Bernie Madoff. When large firms such as Enron, WorldCom and Global Crossing were found guilty of fraud, Wall Street was often blamed, even though these firms had headquarters around the nation and not in Wall Street. Many complained that the resulting Sarbanes-Oxley legislation dampened the business climate with regulations that were "overly burdensome." Interest groups seeking favour with Washington lawmakers, such as car dealers, have often sought to portray their interests as allied with Main Street rather than Wall Street, although analyst Peter Overby on National Public Radio suggested that car dealers have written over $250 billion in consumer loans and have real ties with Wall Street. When the United States Treasury bailed out large financial firms, to ostensibly halt a downward spiral in the nation's economy, there was tremendous negative political fallout, particularly when reports came out that monies supposed to be used to ease credit restrictions were being used to pay bonuses to highly paid employees. Analyst William D. Cohan argued that it was "obscene" how Wall Street reaped "massive profits and bonuses in 2009" after being saved by "trillions of dollars of American taxpayers' treasure" despite Wall Street's "greed and irresponsible risk-taking." Washington Post reporter Suzanne McGee called for Wall Street to make a sort of public apology to the nation, and expressed dismay that people such as Goldman Sachs chief executive Lloyd Blankfein hadn't expressed contrition despite being sued by the SEC in 2009. McGee wrote that "Bankers aren't the sole culprits, but their too-glib denials of responsibility and the occasional vague and waffling expression of regret don't go far enough to deflect anger."

But chief banking analyst at Goldman Sachs, Richard Ramsden, is "unapologetic" and sees "banks as the dynamos that power the rest of the economy." Ramsden believes "risk-taking is vital" and said in 2010:

| “ | You can construct a banking system in which no bank will ever fail, in which there's no leverage. But there would be a cost. There would be virtually no economic growth because there would be no credit creation. -- Richard Ramsden of Goldman Sachs, 2010. | ” |

Others in the financial industry believe they've been unfairly castigated by the public and by politicians. For example, Anthony Scaramucci reportedly told President Barack Obama in 2010 that he felt like a piñata, "whacked with a stick" by "hostile politicians".

The financial misdeeds of various figures throughout American history sometimes casts a dark shadow on financial investing as a whole, and include names such as William Duer, Jim Fisk and Jay Gould (the latter two believed to have been involved with an effort to collapse the U.S. gold market in 1869) as well as modern figures such as Bernard Madoff who "bilked billions from investors".

In addition, images of Wall Street and its figures have loomed large. The 1987 Oliver Stone film Wall Street created the iconic figure of Gordon Gekko who used the phrase "greed is good", which caught on in the cultural parlance. According to one account, the Gekko character was a "straight lift" from the real world junk-bond dealer Michael Milkin, who later pled guilty to felony charges for violating securities laws. Stone commented in 2009 how the movie had had an unexpected cultural influence, not causing them to turn away from corporate greed, but causing many young people to choose Wall Street careers because of that movie. A reporter repeated other lines from the film:

| “ | I’m talking about liquid. Rich enough to have your own jet. Rich enough not to waste time. Fifty, a hundred million dollars, Buddy. A player. -- lines from the script of Wall Street | ” |

Wall Street firms have however also contributed to projects such as Habitat for Humanity as well as done food programs in Haiti and trauma centers in Sudan and rescue boats during floods in Bangladesh.

Wall Street as a Culture

In the public imagination, Wall Street represents, elitism, finance, economics and greed. It is important to note Wall Street employees may exhibit greedy and self-interested behaviours to the public, these behaviours are justified through their own value system and social practices. Karen Ho mentions in Situating Global Capitalisms, that markets are beginning to self-regulate themselves in terms of neoliberalism . The ideology of neoliberalism is where the rich can get richer at the expense of the poor. This philosophy is embodied by Wall Street’s values of individuality, materialism and greed. They are also not unlike our North American values; meaning, North Americans are capitalistic individuals. The difference between the two groups is one’s wealth is compared to another in the same society, while the other is comparing country’s wealth and status. Calling Wall Street a culture is appropriate because of the system of values and practices it holds onto. Through the perception of the public, financial investors take on a role that has already been established for them.

Within the media, negative images of Wall Street are painted in terms of the district’s market falls, money losses and deceitful gains . However, this is not what the Wall Street investors are bothered by. Instead, it is the public’s words and opinions which they feel mold their image . Sjöberg notes that in the American culture, money making is of utmost importance and knowing how to make money is considered to be respectable. Therefore, Wall Street investors prioritize their work as well as strive to climb the corporate ladder . They also feel obligated to maintain the image the public creates, because it strengthens their position. They value seeing themselves as experts in their field, especially since they live in a society that values wealth . This justifies their acts of greed, and allows them to take part in activities often deemed as criminal because they feel as though it is expected. Moreover, they do not regret their actions because to them, it is part of being an American . Aside from living up to the public’s image, Wall Street workers justify their high salaries with an argument pointed out by Ho in Disciplining Investment Bankers, Disciplining the Economy: Wall Street’s Institutional Culture of Crisis, the Downsizing of Corporate America. Her argument is that the financial market is volatile and with the existence of job insecurity, they are compensated through their salaries .

In Situating Global Capitalisms: A View from Wall Street Investment Bankers by anthropologist Karen Ho interviews a banker who believes working for Wall Street puts them at the top. He feels that everything goes through Wall Street in terms of loans, investments, change or growth . It is part of living in a global capitalistic world. From his point of view, Wall Street values are embedded in power . This is seen in Sjöberg’s article, The Wall Street Culture, where she states that as she was entering the New York Stock Exchange (NYSE) to conduct an interview, she was questioned by many employees regarding her purpose, not everyone can gain access into their workplace without an appointment, and that there is high security . In their view, the “dividing line between ‘us on the inside’ and ‘those on the outside’” is what keeps Wall Street a place where they belong. These factors strengthen the power relations as well as establish a hierarchy between them and the public .

Additionally, in Disciplining investment Bankers, Disciplining the Economy: Wall Street’s Institutional Culture of Crisis and the Downsizing of “Corporate America”, Karen Ho says that as we continue to learn more about Wall Street, we learn about each independent banker. As the banker brings their life experiences into the business, we can see the reasons for their actions. Each investor has their own unique identity which contributes to the culture of Wall Street. Ideally, they live in the moment However, job insecurity and the volatile nature of the market creates a constant state of fear within the investor . Therefore, they must organize themselves and follow a pattern to ensure security, profit and prosperity for the long run . Karen Ho wishes for us to see Wall Street through the lens of the everyday investor and banker, as well as understand the experiences and everyday situations that they must endure. Ho says we can counteract the stereotypes and negativity that the media and society associates with Wall Street, by learning more about the personal experiences of the investors and their everyday lives . Similarly to regular wage earners, they are just trying to earn a day's pay. Their work is sometimes undervalued, because the public does not see them in this manner. Thus, Wall Street cannot be understood in black and white terms. One needs to understand that they have a value system which is reflective of North America’s values in terms of power, prestige, and social practices.

Wall Street in popular culture

- In the fictional Star Trek universe, Wall Street is frequently visited by Ferengi pilgrims, who revere it as a holy site of commerce and business. ( Star Trek: Voyager episode 11:59)

- Herman Melville's classic short story Bartleby, the Scrivener is subtitled A Story of Wall Street and provides an excellent portrayal of the alienating forces at work within the confines of Wall Street.

- In William Faulkner's novel The Sound and the Fury, Jason Compson hits on other perceptions of Wall Street: after finding some of his stocks are doing poorly, he blames "the Jews."

- The film Die Hard with a Vengeance has a plot involving thieves breaking into the Federal Reserve Bank of New York and stealing most of the gold bullion stored underground by driving dump trucks through a nearby Wall Street subway station.

- Many events of Tom Wolfe's Bonfire of the Vanities centre on Wall Street and its culture.

- On January 26, 2000, the band Rage Against The Machine filmed the music video for "Sleep Now in the Fire" on Wall Street, which was directed by Michael Moore. The band at one point stormed the Stock Exchange, causing the doors of the Exchange to be closed early (2:52 P.M.). Trading on the Exchange floor, however, continued uninterrupted.

- The 1987 film Wall Street and its 2010 sequel exemplify many popular conceptions of Wall Street, being a tale of shady corporate dealings and insider trading.

- "Wallstreet Kingdom" is a controversial fashion brand promoting capitalism and bonuses on Wall Street.

- In the film National Treasure a clue to finding the Templar Treasure leads the main characters to Wall Street's Trinity Church.

- TNA Wrestler Robert Roode is billed from "Wall Street in Manhattan, New York."

- Bret Easton Ellis's novel American Psycho follows the day-to-day life of Wall Street investment banker and serial killer Patrick Bateman.

- In the video game Grand Theft Auto IV in the fictional Liberty City Wall Street is a district dubbed The Exchange.

- Battles 2011 album Gloss Drop contains a song titled "Wall Street."

- In the video game Call of Duty: Modern Warfare 3, in 2016, soldiers are sent to destroy an invader's radar jamming installation on top of the New York Stock Exchange.

- In the video game Crysis 2, Wall Street is featured as a multiplayer map as well as a singleplayer location.

- In the Chandran Rutnam set to direct film Prince of Malacca, a Wall Street billionaire hedge fund manager, after seeking nadi astrology in India, is getting into a double deal by becoming a CIA’s intelligence officer with a special directive from the President of the United States of America to detect a drug cartel in Southeast Asia, in an exchange for using space and satellite technology to locate an island in the Strait of Malacca where in a tribal community his lover of previous birth is born as a beautiful dancer.

- Ska/punk band Big D and the Kids Table released their song "It's Raining Zombies On Wall Street" on their new album For the Damned, the Dumb & the Delirious. The song is about the Occupy Wall Street Movement.

- In the film The Dark Knight Rises, Bane attacks the Gotham City Stock Exchange. Scenes were filmed in and around the New York Stock Exchange, with the J.P. Morgan Building at Wall Street and Broad Street standing in for the Exchange.

- "Walking On Wall Street" is the name of a song from Schoolhouse Rock!.

Competitors to Wall Street

See Financial centre

Transportation

Wall Street being historically a commuter destination, much transportation infrastructure has been developed to serve it. Today, Pier 11 at the foot of the street is a busy terminal for New York Waterway and other ferries. The New York City Subway has three stations under Wall Street:

- Wall Street (IRT Broadway – Seventh Avenue Line) at William Street ( 2 3 trains)

- Wall Street (IRT Lexington Avenue Line) at Broadway ( 4 5 trains)

- Broad Street (BMT Nassau Street Line) at Broad Street ( J Z trains)

Motor traffic, particularly during working hours, is often congested but driving late at night and on weekends can be easier. The roads are not arranged according to midtown's distinctive rectangular grid pattern with staggered lights, but have small often one-lane roads with numerous stoplights and stop signs. A highway runs along the East River and the Downtown Manhattan Heliport serves Wall Street.