Marginal cost

Did you know...

SOS believes education gives a better chance in life to children in the developing world too. Click here for more information on SOS Children.

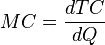

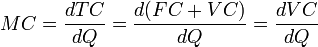

In economics and finance, marginal cost is the change in total cost that arises when the quantity produced changes by one unit. Mathematically, the marginal cost (MC) function is expressed as the derivative of the total cost (TC) function with respect to quantity (Q). Note that the marginal cost may change with volume, and so at each level of production, the marginal cost is the cost of the next unit produced.

In general terms, marginal cost at each level of production includes any additional costs required to produce the next unit. If producing additional vehicles requires, for example, building a new factory, the marginal cost of those extra vehicles includes the cost of the new factory. In practice, the analysis is segregated into short and long-run cases, and over the longest run, all costs are marginal. At each level of production and time period being considered, marginal costs include all costs which vary with the level of production, and other costs are considered fixed costs.

It is a general principle of economics that a (rational) producer should always produce (and sell) the last unit if the marginal cost is less than the market price. As the market price will be dictated by supply and demand, it leads to the conclusion that marginal cost equals marginal revenue. These general principles are subject to a number of other factors and exceptions, but marginal cost and marginal cost pricing play a central role in economic definitions of efficiency.

Marginal cost pricing is the principle that the market will, over time, cause goods to be sold at their marginal cost of production. Whether goods are in fact sold at their marginal cost will depend on competition and other factors, as well as the time frame considered. In the most general criticism of the theory of marginal cost pricing, economists note that monopoly power may allow a producer to maintain prices above the marginal cost; more specifically, if a good has low elasticity of demand (consumers are insensitive to changes in price) and supply of the product is limited (or can be limited), prices may be considerably higher than marginal cost. Since this description applies to most products with established brands, marginal pricing may be relatively rare; an example would be in markets for commodities.

A number of other factors can affect marginal cost and its applicability to real world problems. Some of these may be considered market failures. These may include information asymmetries, the presence of negative or positive externalities, transaction costs, price discrimination and others.

Cost functions and relationship to average cost

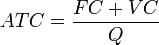

In the most simple case, the total cost function and its derivative are expressed as follows, where Q represents the production quantity, VC represents variable costs (costs that vary with Q), and FC represents fixed costs:

Since (by definition) fixed costs do not vary with production quantity, it drops out of the equation when it is differentiated. The important conclusion is that marginal cost is not related to fixed costs. This can be compared with average total cost or ATC, which is the total cost divided by the number of units produced and does include fixed costs.

For discrete calculation without calculus, marginal cost equals the change in total (or variable) cost that comes with each additional unit produced. For instance, suppose the total cost of making 1 shoe is $30 and the total cost of making 2 shoes is $40. The marginal cost of producing the second shoe is $40 - $30 = $10.

Economies of scale

Production may be subject to economies of scale (or diseconomies of scale). Increasing returns to scale are said to exist if additional units can be produced for less than the previous unit, that is, average cost is falling. This can only occur if average cost at any given level of production is higher than the marginal cost. Conversely, there may be levels of production where marginal cost is higher than average cost, and average cost will rise for each unit of production after that point. This type of production function is generically known as diminishing marginal productivity: at low levels of production, productivity gains are easy and marginal costs falling, but productivity gains become smaller as production increases; eventually, marginal costs rise because increasing output (with existing capital, labour or organization) becomes more expensive. For this generic case, minimum average cost occurs at the point where average cost and marginal cost are equal (when plotted, the two curves intersect); this point will not be at the minimum for marginal cost if fixed costs are greater than zero.

Short and long run costs and economies of scale

A textbook distinction is made between short-run and long-run marginal cost. The former takes as unchanged, for example, the capital equipment and overhead of the producer, any change in its production involving only changes in the inputs of labour, materials and energy. The latter allows all inputs, including capital items (plant, equipment, buildings) to vary.

A long-run cost function describes the cost of production as a function of output assuming that all inputs are obtained at current prices, that current technology is employed, and everything is being built new from scratch. In view of the durability of many capital items this textbook concept is less useful than one which allows for some scrapping of existing capital items or the acquisition of new capital items to be used with the existing stock of capital items acquired in the past. Long-run marginal cost then means the additional cost or the cost saving per unit of additional or reduced production, including the expenditure on additional capital goods or any saving from disposing of existing capital goods. Note that marginal cost upwards and marginal cost downwards may differ, in contrast with marginal cost according to the less useful textbook concept.

Economies of scale are said to exist when marginal cost according to the textbook concept falls as a function of output and is less than the average cost per unit. This means that the average cost of production from a larger new built-from-scratch installation falls below that from a smaller new built-from-scratch installation. Under the more useful concept, with an existing capital stock, it is necessary to distinguish those costs which vary with output from accounting costs which will also include the interest and depreciation on that existing capital stock, which may be of a different type from what can currently be acquired in past years at past prices. The concept of economies of scale then does not apply.

Externalities

Externalities are costs (or benefits) that are not borne by the parties to the economic transaction. A producer may, for example, pollute the environment, and others may bear those costs. A consumer may consume a good which produces benefits for society, such as education; because the individual does not receive all of the benefits, he may consume less than efficiency would suggest. Alternatively, an individual may be a smoker or alcoholic and impose costs on others. In these cases, production or consumption of the good in question may differ from the optimum level.

Negative externalities of production

Much of the time, private and social costs do not diverge from one another, but at times social costs may be either greater or less than private costs. When marginal social costs of production are greater than that of the private cost function, we see the occurrence of a negative externality of production. Productive processes that result in pollution are a textbook example of production that creates negative externalities.

Such externalities are a result of firms externalising their costs onto a third party in order to reduce their own total cost. As a result of externalising such costs we see that members of society will be negatively affected by such behaviour of the firm. In this case, we see that an increased cost of production on society creates a social cost curve that depicts a greater cost than the private cost curve.

In an equilibrium state we see that markets creating negative externalities of production will overproduce that good. As a result, the socially optimal production level would be lower than that observed.

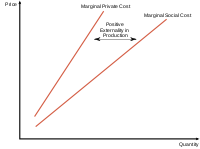

Positive externalities of production

When marginal social costs of production are less than that of the private cost function, we see the occurrence of a positive externality of production. Production of public goods are a textbook example of production that create positive externalities. An example of such a public good, which creates a divergence in social and private costs, includes the production of education. It is often seen that education is a positive for any whole society, as well as a positive for those directly involved in the market.

Examining the relevant diagram we see that such production creates a social cost curve that is less than that of the private curve. In an equilibrium state we see that markets creating positive externalities of production will under produce that good. As a result, the socially optimal production level would be greater than that observed.

Social costs

Of great importance in the theory of marginal cost is the distinction between the marginal private and social costs. The marginal private cost shows the cost associated to the firm in question. It is the marginal private cost that is used by business decision makers in their profit maximization goals, and by individuals in their purchasing and consumption choices. Marginal social cost is similar to private cost in that it includes the cost functions of private enterprise but also that of society as a whole, including parties that have no direct association with the private costs of production. It incorporates all negative and positive externalities, of both production and consumption.

Hence, when deciding whether or how much to buy, buyers take account of the cost to society of their actions if private and social marginal cost coincide. The equality of price with social marginal cost, by aligning the interest of the buyer with the interest of the community as a whole is a necessary condition for economically efficient resource allocation.

Other cost definitions

- Fixed costs are costs which do not vary with output, for example, rent. In the long run all costs can be considered variable.

- Variable cost also known as, operating costs, prime costs, on costs and direct costs, are costs which vary directly with the level of output, for example, labour, fuel, power and cost of raw material.

- Social costs of production are costs incurred by society, as a whole, resulting from private production.

- Average total cost is the total cost divided by the quantity of output.

- Average fixed cost is the fixed cost divided by the quantity of output.

- Average variable cost are variable costs divided by the quantity of output.