Quasi-equity financing is a financing term for funding that is technically “debt” but

has some of the characteristics of equity financing, such as unsecured funding with

flexible repayment terms.39

Debt is money lent to an enterprise; the amount of money borrowed and the

interest on the amount has to be repaid to the lender. Unlike equity, the lenders do

not own a share in the enterprise. To ensure the loan can be repaid the lender

requires strict criteria relating to the profitability of the project and proportion of debt

compared to other finance sources is met.

Finance for an NGO project or enterprise may be obtained from a single or

combination of finance types. All of the projects described in the previous section

involved grant funding at some point, either in the early stages of the project or

more extensively through the initiative lifecycle (which may involve several

“projects”). However, none rely entirely on grants and blend grants with other types

of finance in some aspects of the implementation or delivery model, particularly

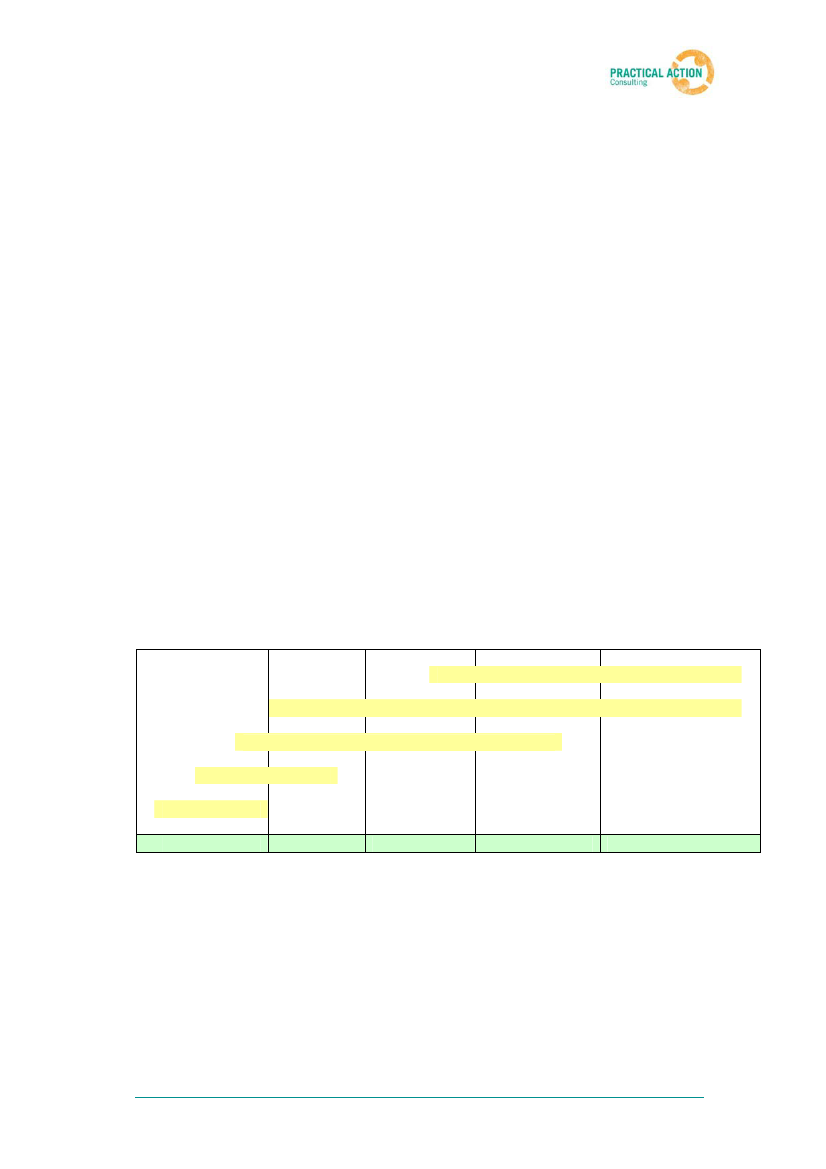

with regard to energy enterprises active within the wider model. Investment for a

sustainable energy enterprise typically follows the stages of growth described in

Table 7. Enterprises use a mix of internal finance, grants, equity and debt.

NGOs typically rely heavily on grants. Using equity and debt may be appropriate to

increase the available finance for a project and encourage financially sustainable

operations.

A finance expert should be consulted to discuss the best financial framework for a

particular project or enterprise.

Table 7: Typical stages of growth for an enterprise. Adapted from Ashden

Awards.38

Venture funds - equity

Market-based loans

Social investment – soft-loans and equity

Grants

Internal finance

Pre-start

Start-up

Consolidation

Early growth

Sustained growth

3.2.

Operational models

NGOs and enterprises have developed innovative operational models to provide

potential customers with access to finance (commonly called “micro-finance”) for

purchasing energy products and services. This is often necessary given poor

people’s lack of purchasing power, access to formal finance added to typically

limited awareness of energy products and limited capacity of the private sector in

developing countries. There are three main successful models commonly used:

Renewable Energy to Reduce Poverty in Africa

27