Grants do not require repayment; in essence they are gifts of money. They are the

cheapest forms of finance although they usually include strict conditions on how the

money can be spent and the time frame in which it can be spent. Grants may come

from multilateral or bilateral donors, charitable foundations, corporations or

individuals (see Chapter 5). Grants are usually provided as a one-off payment to

help launch a new project or enterprise. They can play a very important role ‘buying

down capital’ or covering some or all of the initial costs of capital investment which

would be difficult to recoup from revenues. Funding agencies can be willing to

provide a grant that will help establish a financially sustainable operation such as

this but are generally unwilling to continue providing grants when they believe

operations can be sustained by selling a product or service profitably.

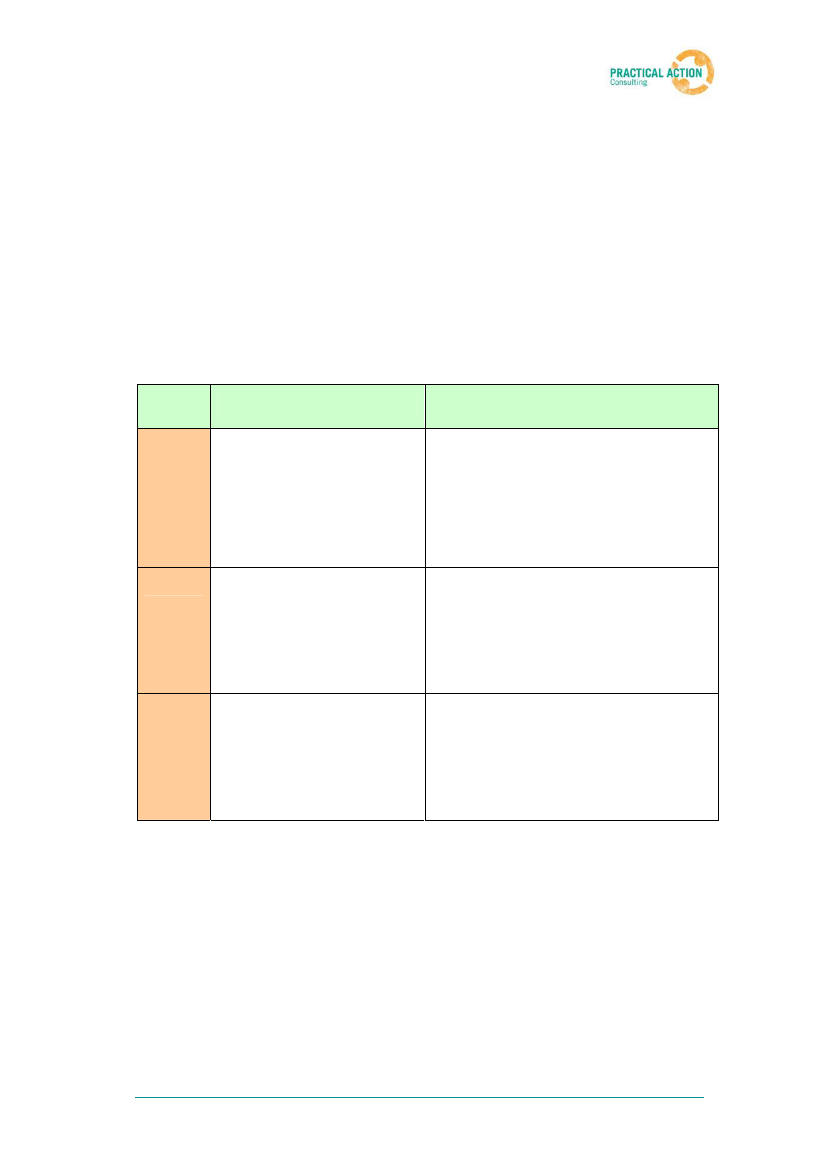

Table 6: Advantages and disadvantages of different types of finance.

Adapted from Ashden Awards. 38

Type of

Finance

Grant

Equity

Debt

Advantages for enterprise

• No need to repay

• The risk is shared with the

investor

• Payback is more flexible than

debt

• Investor more likely to be

active and supportive

• Easy to arrange compared to

equity – especially with a

good track record

• Retain complete control and

ownership

Disadvantages for enterprise

• Grant sizes are typically quite small, and

donor procedures cumbersome, meaning

lots of time can be spent chasing small

amounts of money

• Donors have a limited appetite for

continued funding of the same activity –

requiring innovative ideas or other funders

• Investors require high returns – equity can

be difficult to obtain and expensive

• Negotiation and due diligence processes

are time consuming

• Some control and ownership is

relinquished to the investor

• Difficult to obtain without a good track

record or collateral

• Repayment schedules are typically

inflexible

• Can be difficult to obtain for start-up

enterprises

Equity is the money invested in an enterprise by investors (including founders) with

the expectation of getting a future return. An equity investor will exchange money

for shares; effectively owning a percentage of the company. If the enterprise is

successful the shares will return a dividend payment to the equity investor from the

profits. Risk is shared with the equity investor; if the enterprise becomes bankrupt,

the equity investor can only take a share of the assets remaining after other

creditors have been paid. Equity is more flexible than debt since the repayments

are linked to operating profits. Investors are therefore more likely to be active in

providing support to the enterprise.

Renewable Energy to Reduce Poverty in Africa

26